Reading books on how to manage finances is one of the tips that you can do

as part of self-development. There are many benefits of reading that can be

obtained. In addition to increasing your knowledge, your knowledge will be

wider and you can apply the knowledge taught in everyday life.

In this case, reading books that teach you how to manage finances will make

you smarter in allocating money, managing expenses so that they are not big

pegs than pillars, and can have healthy finances so that you have a better

future.

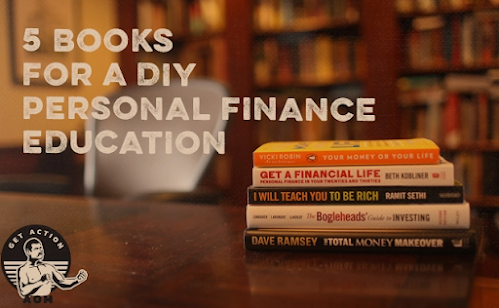

5 Books That Teach You How to Manage Your Finances

How to properly manage finances needs to be learned because it is very

important to help achieve healthy financial conditions. Especially at a time

when many people are trapped in a hedonistic lifestyle that does not match

their abilities. Not a few who end up getting into debt with high interest

and unable to pay it.

You should be more vigilant in managing finances. As a reference to being

able to have the ability to manage money in and out, you can learn online

about financial planning.

In addition to learning from various online media, such as taking free

online courses on online learning applications, from YouTube, or

participating in webinars, you can also read various books that discuss how

to manage finances, including:

Best Memoir: Rich Dad Poor Dad

Rich Dad Poor Dad is the title of a very well-known book for studying

finance. This book, written by Robert Kiyosaki, has been a best seller for

more than twenty years and is the first book to discuss personal finance.

In the book Rich Dad Poor Dad, Robert Kiyosaki tells about his father's

habit of mediocre finances compared to the habits of his friend's father who

is very rich. From this fact, it is explained about the financial quadrant

and how to achieve financial freedom.

Best for Debt Management: The Total Money MakeOver

The next recommended book on how to manage finances is a book by Dave Ramsey

entitled The Total Money MakeOver. This book does not teach to get rich

quick, but there are things that are more important than just being rich,

namely a solid foundation for healthy finances.

This book explains household budget issues, such as financial communication

in a marriage and how to pay bills when the kids are going to college.

This book also teaches about the importance of saving and having an

emergency fund to secure the future. So that when undesirable conditions

occur, the family's finances are not disturbed.

Best Overall: Why Didn't They Teach Me This in School?

This book was written by Cary Siegel because he realized that education in

schools is not enough to teach children to manage finances. In fact, how to

manage finances needs to be known since I was a child so that you get used

to it when you are an adult.

Cary Siegel summarizes how to manage finances into eight comprehensive

discussions. There are 3 important points in this book with no more than 200

pages, namely about life lessons, budgeting and saving lessons, and spending

lessons.

Studying finance from this book will allow you to know how to prioritize

needs and prioritize money allocations properly.

Best For Budgeting: Your Money or Your Life

The title of the next book that you deserve to read is Your Money or Your

Life. This book on how to manage finances teaches about how to live

according to financial capabilities, so that there is no financial deficit.

This book offers a different point of view than most people. The author says

that a frugal life can actually make you feel happier. So you can enjoy the

simple things that are sometimes overlooked, including giving tips to change

wasteful habits.

Best for Inspiration: The Millionaire Next Door

The book The Millionaire Next Door was written by Thomas J Stanley and

William D Danko and entered the ranks of bestsellers in 1998. It is about

seven common traits shared by millionaires.

The facts told in this book are the result of years of research by the

author. It turns out that most rich people work hard, live frugally, and

save their income. You can take it as inspiration and follow how the habits

of the rich save and make their money grow.

The benefits of reading books on how to manage finances will be greater if

you simultaneously apply what you learn and directly practice managing your

daily finances. You can also share your knowledge and experiences related to

financial management with your family and friends. So you can help improve

the financial literacy of the people around you.